Variants for Form 1099 As of , several versions of Form 1099 are used, depending on the nature of the income transaction 1099A Acquisition or Abandonment of Secured Property;Profit or Loss From a Business ; Keep reading to learn more about the Form 1099K, 1040, Schedule C, Schedule SE and Schedule CEZ forms The 1099K form Everything you should know Selling on Etsy means you're responsible for taking care of your taxes As an independent business owner, you might receive a 1099K form from Etsy, or from payment processors such as PayPal

How To File Schedule C Form 1040 Bench Accounting

Schedule c form 1099 nec

Schedule c form 1099 nec- The Form 1099C denotes debts that have been forgiven by creditors It is also known as a "cancellation of debt" According to the IRS, lenders must file this form for each debtor for whom they canceled $600 or more of a debt owed to them A 1099C is sent when a consumer settles a debt with a creditor, or the creditor has chosen to notForm 1099A Acquisition or Abandonment of Secured Property (Info Copy Only) 19 Form 1099B Proceeds from Broker and Barter Exchange Transactions (Info Copy Only) 21 Form 1099B

1

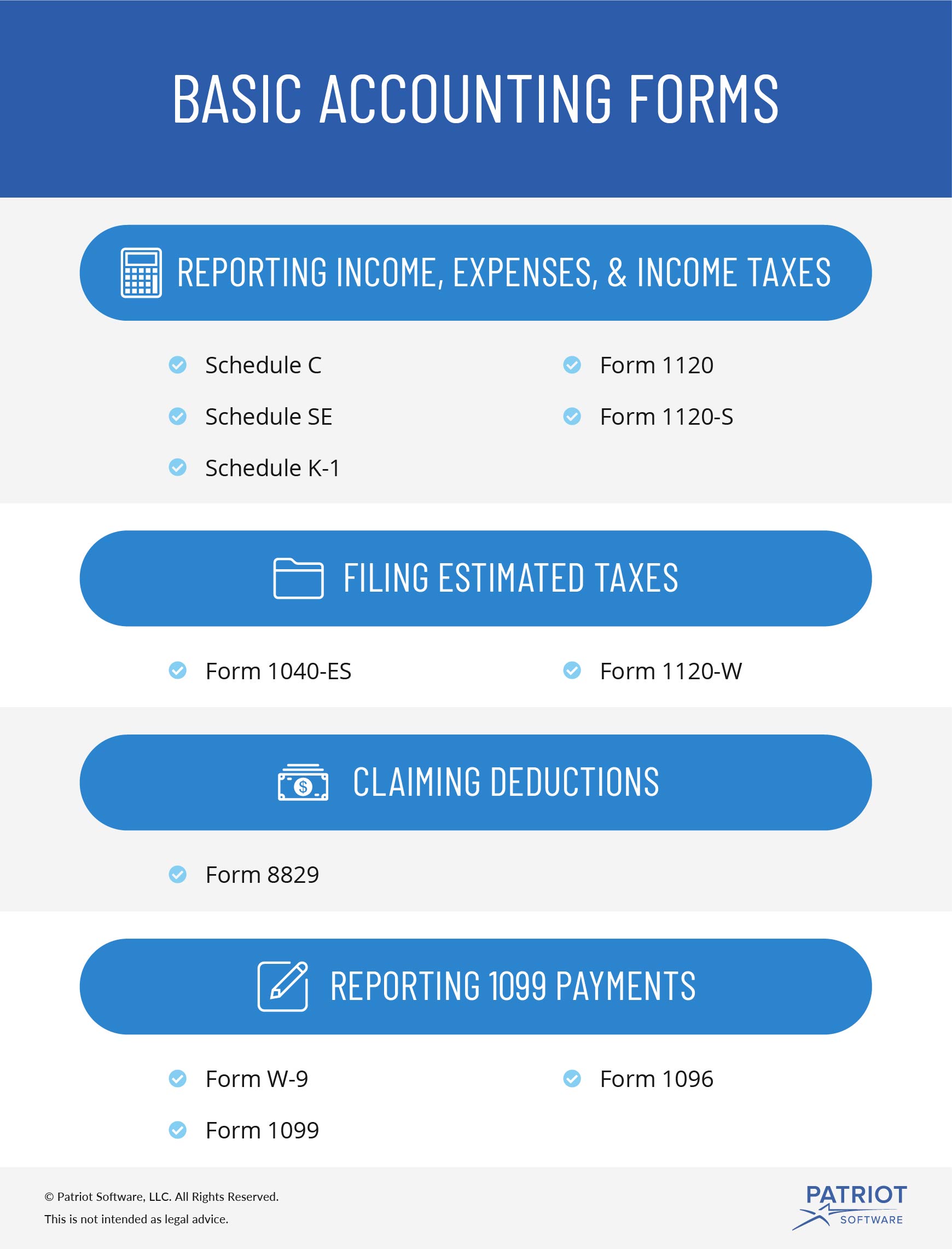

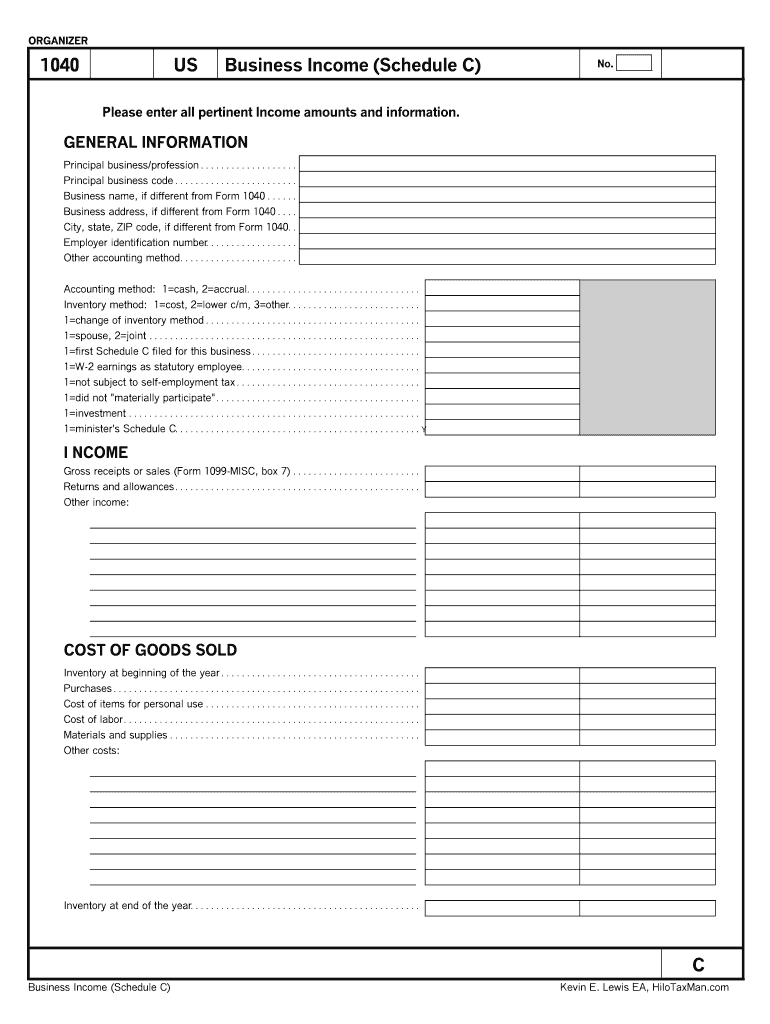

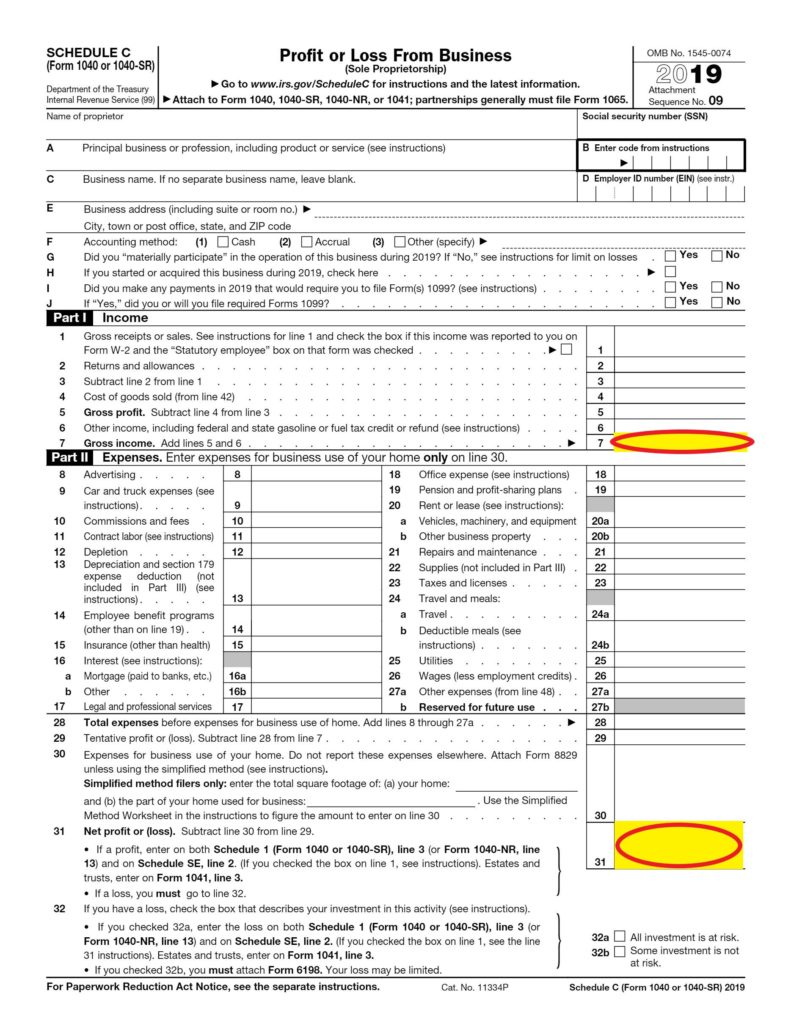

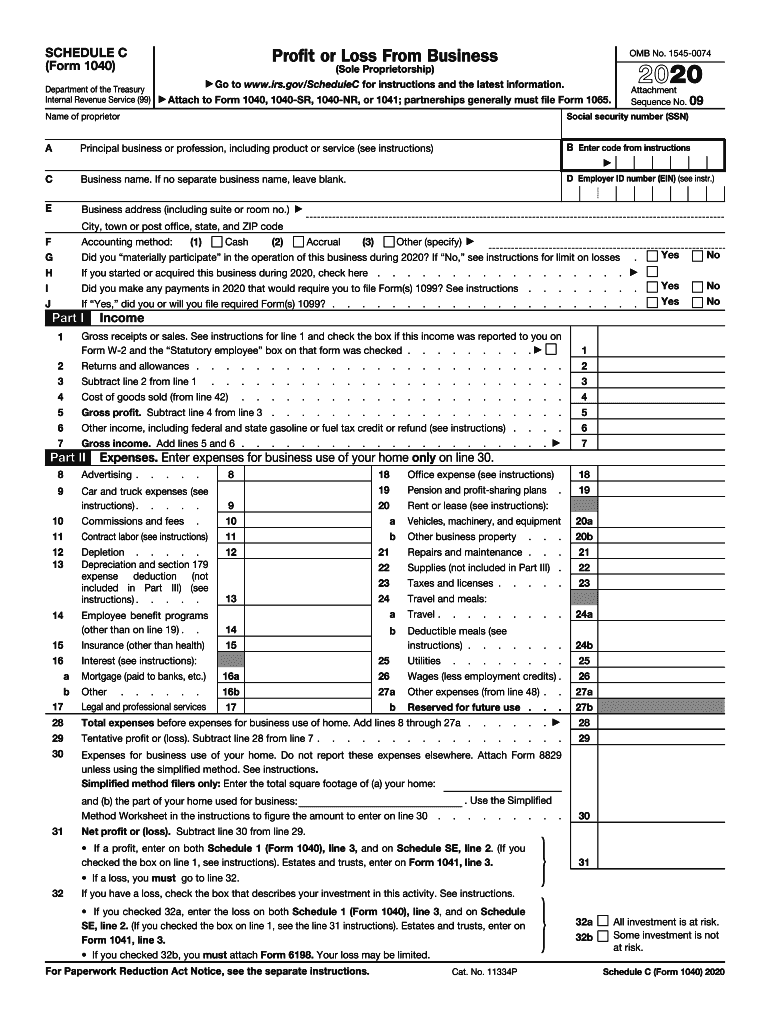

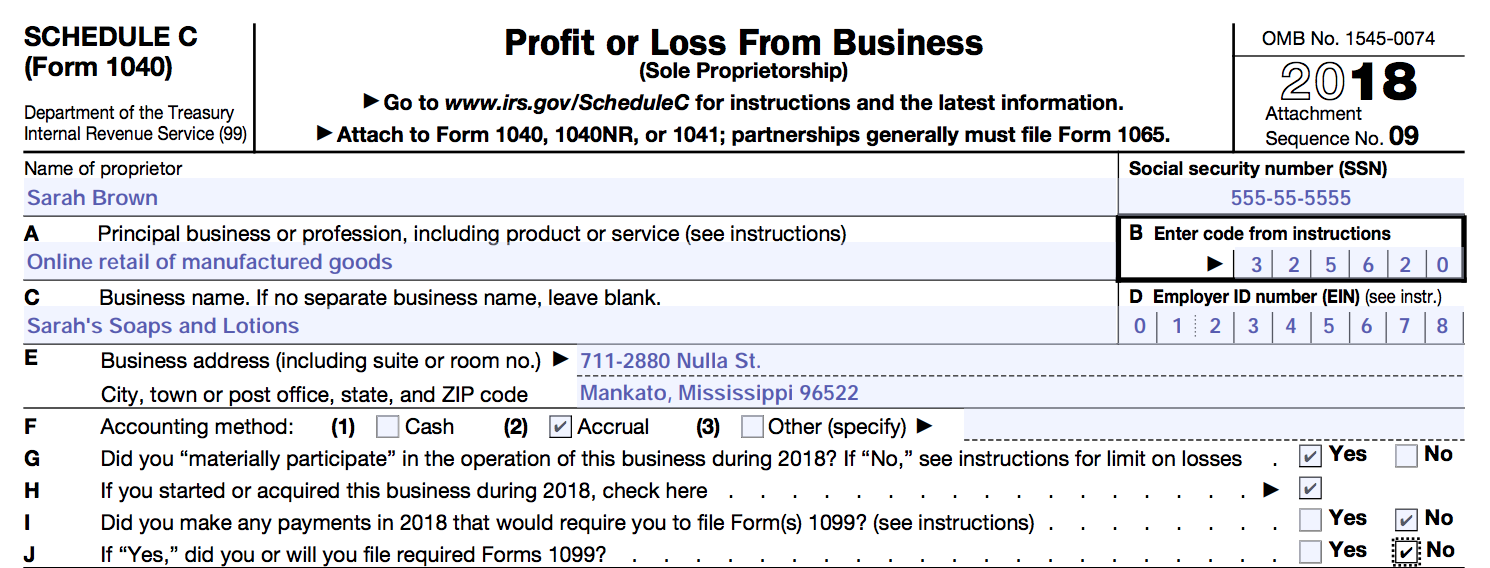

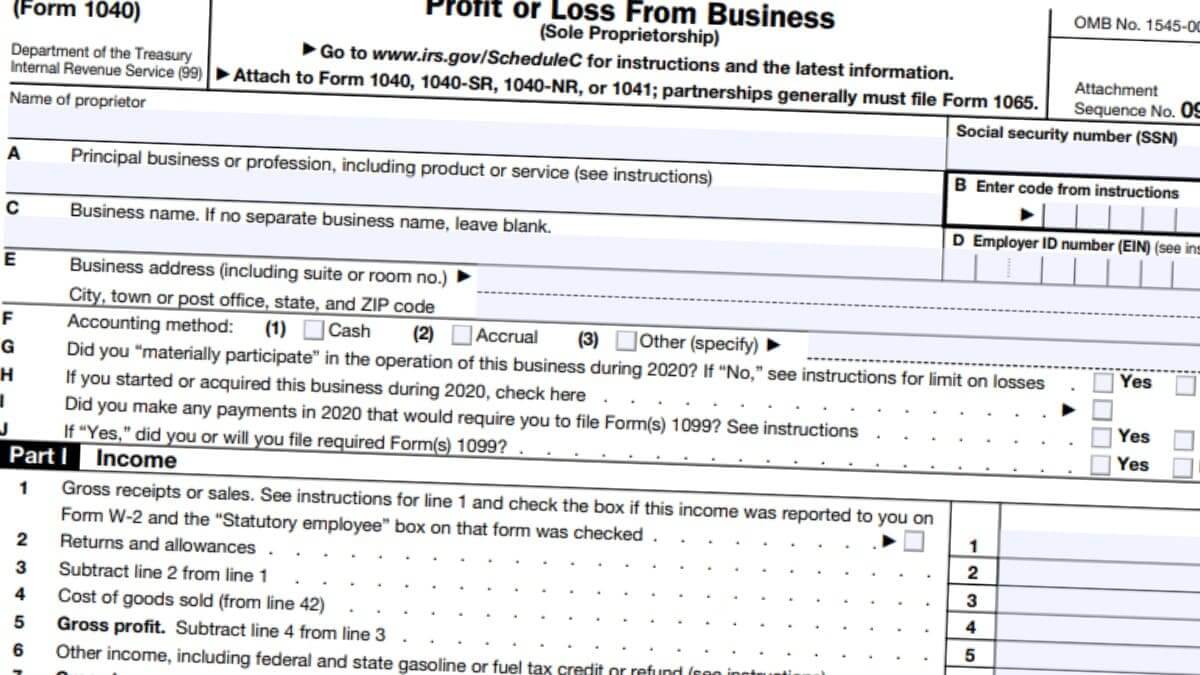

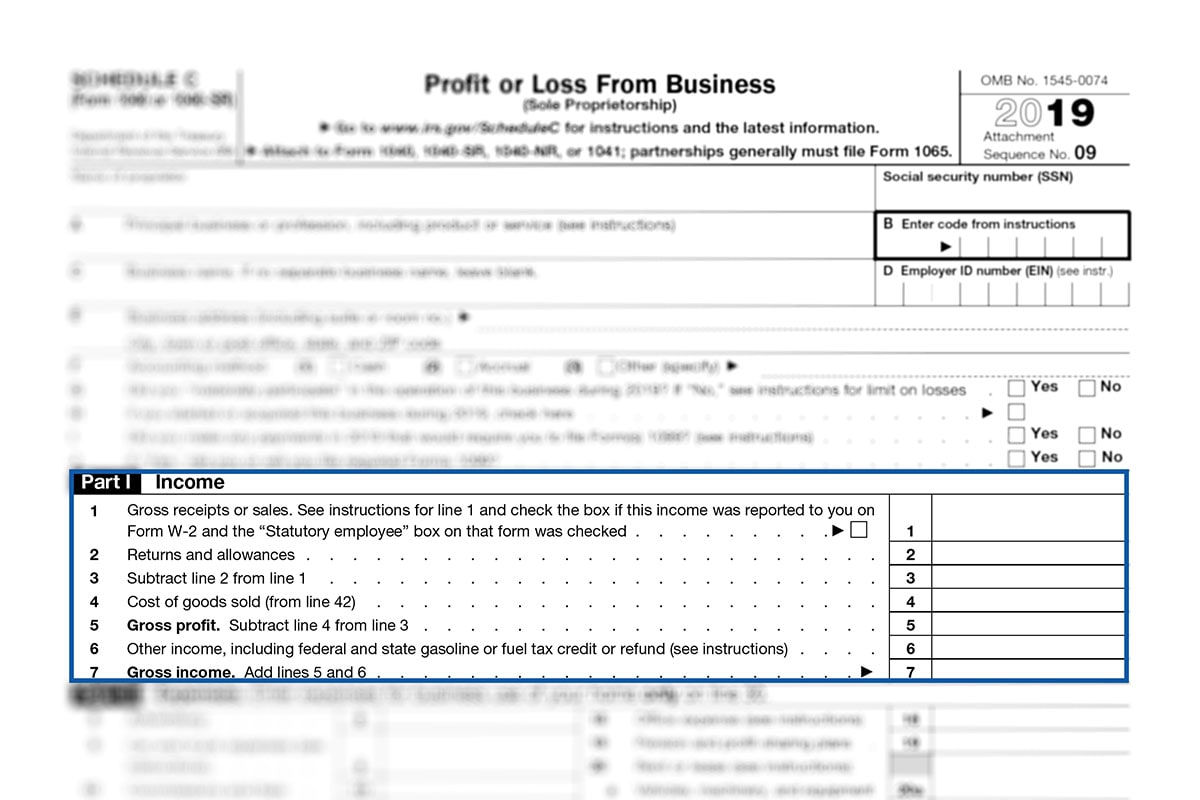

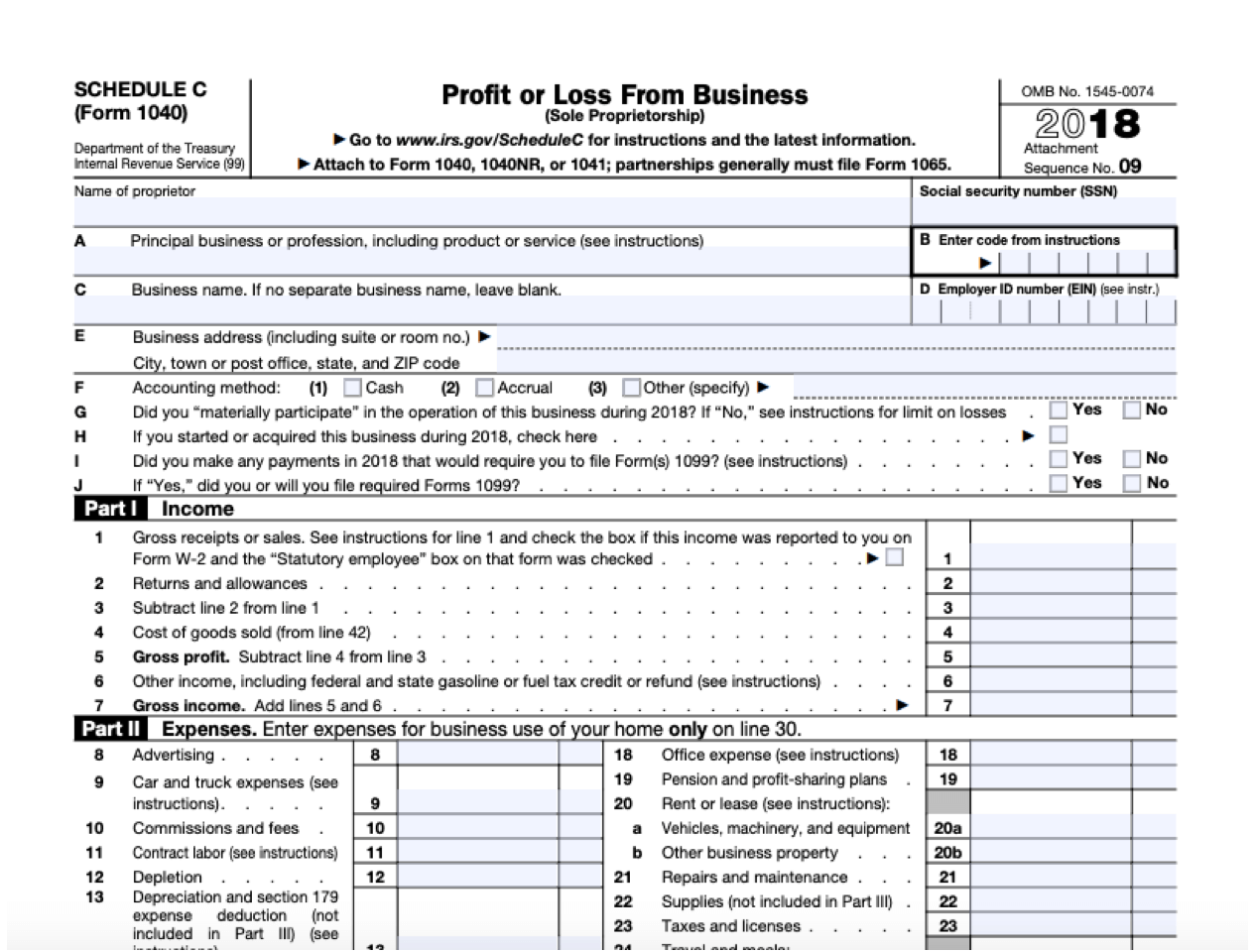

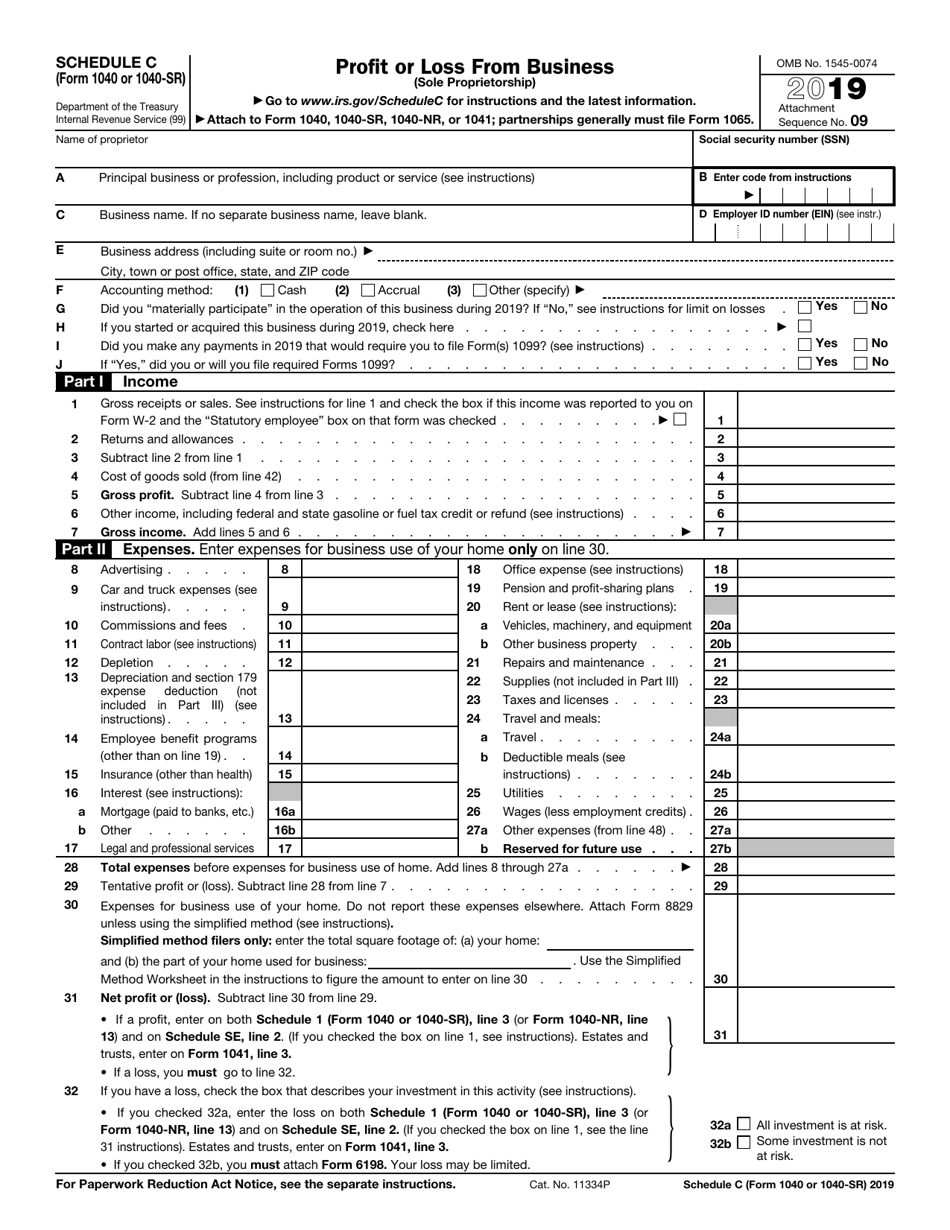

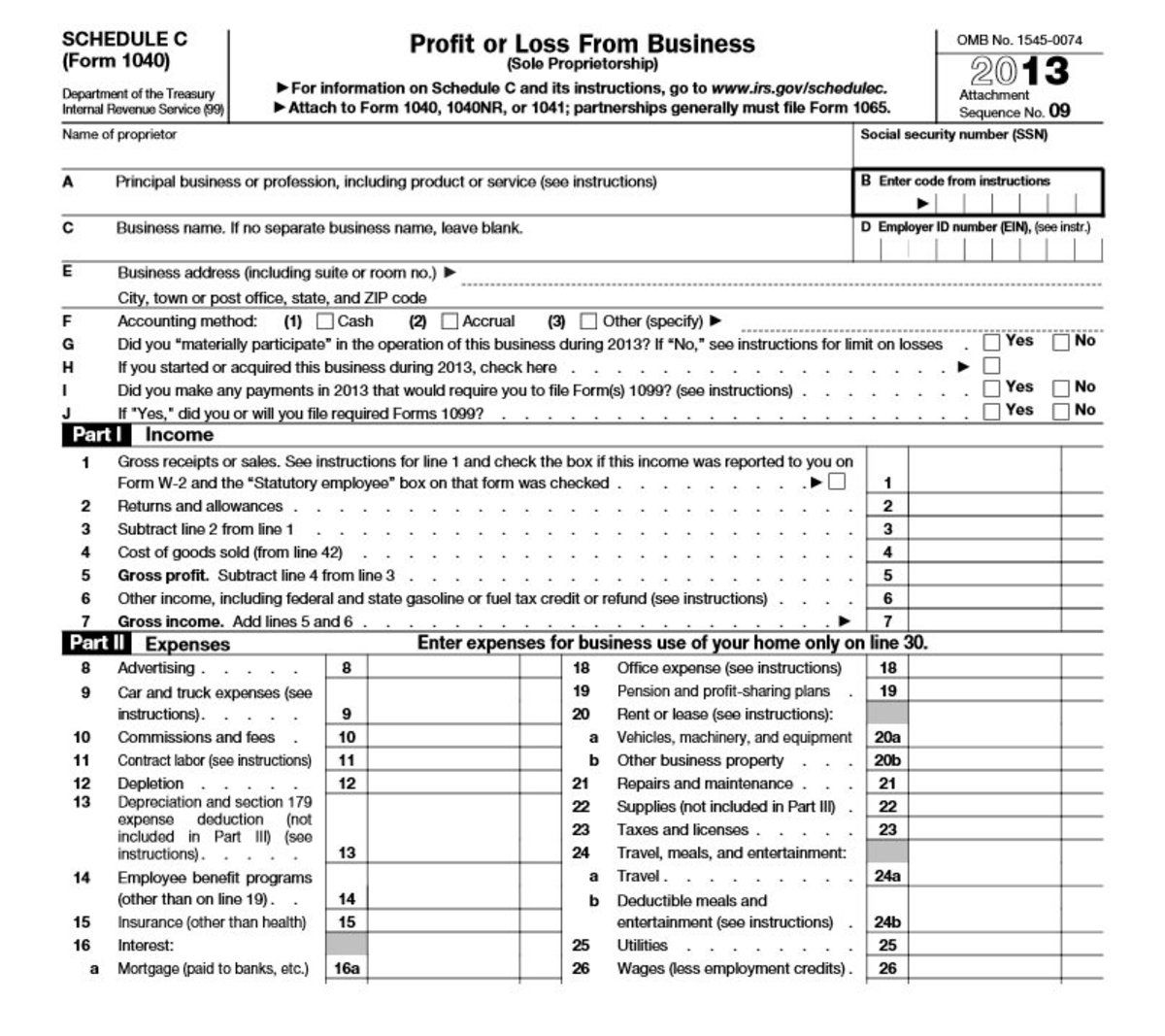

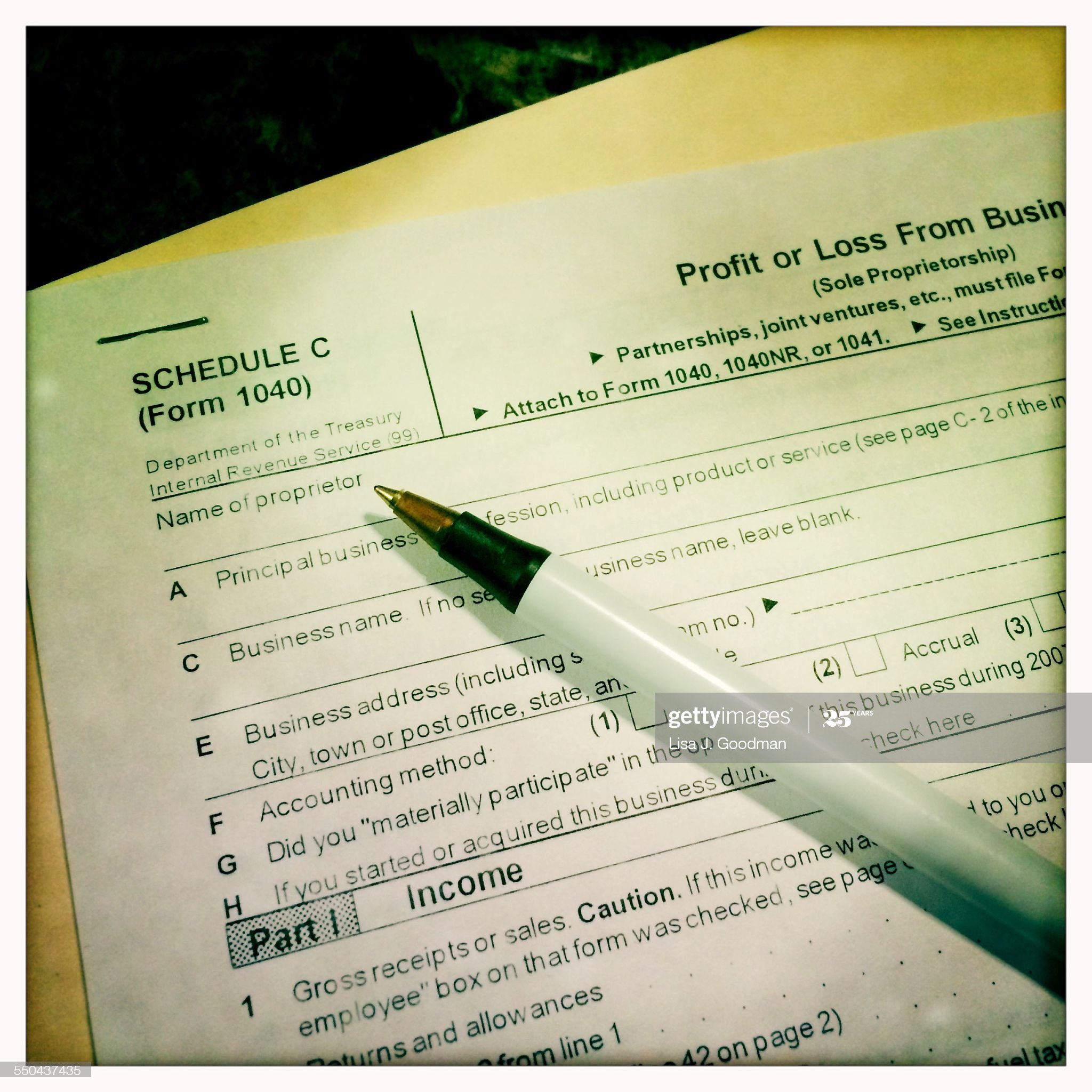

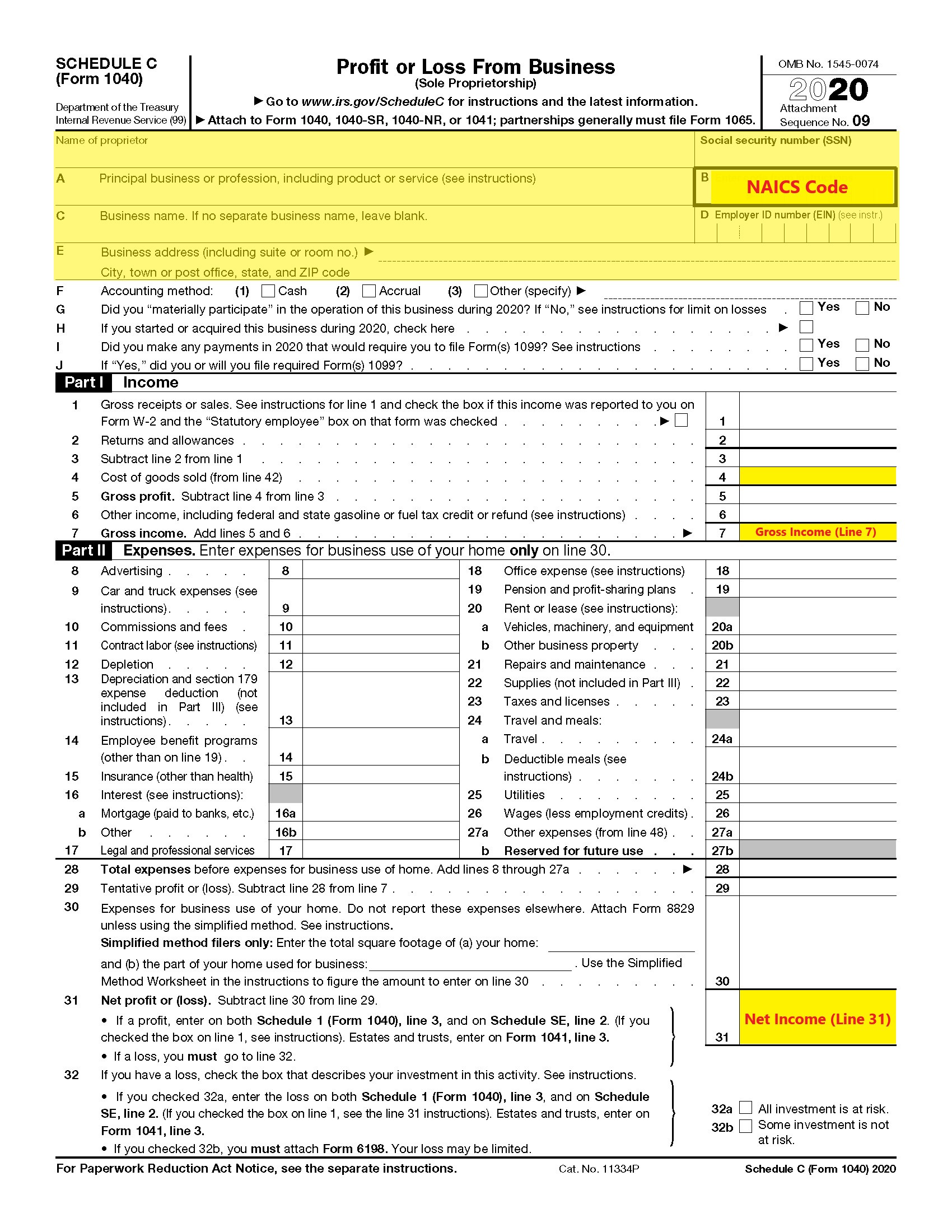

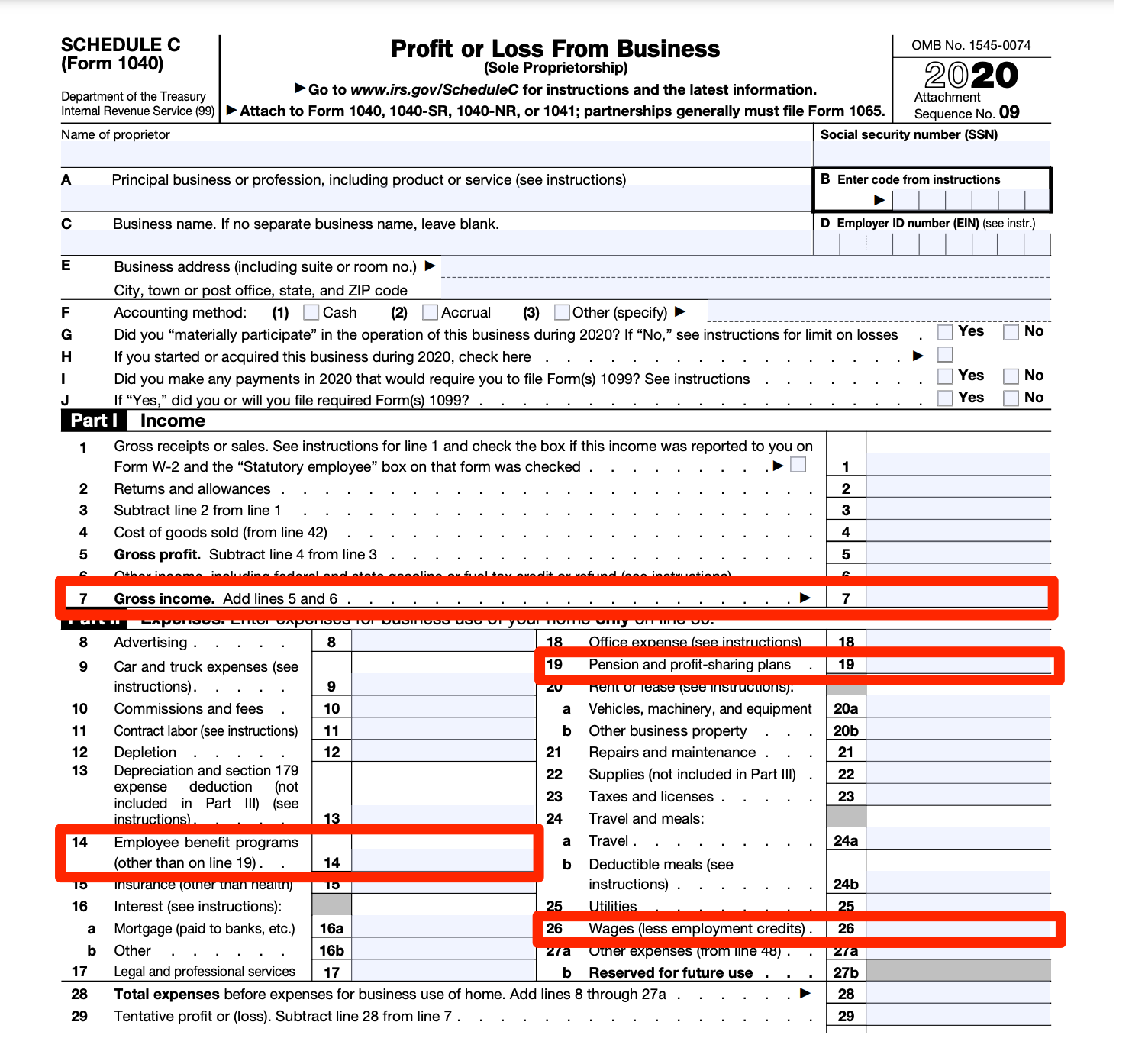

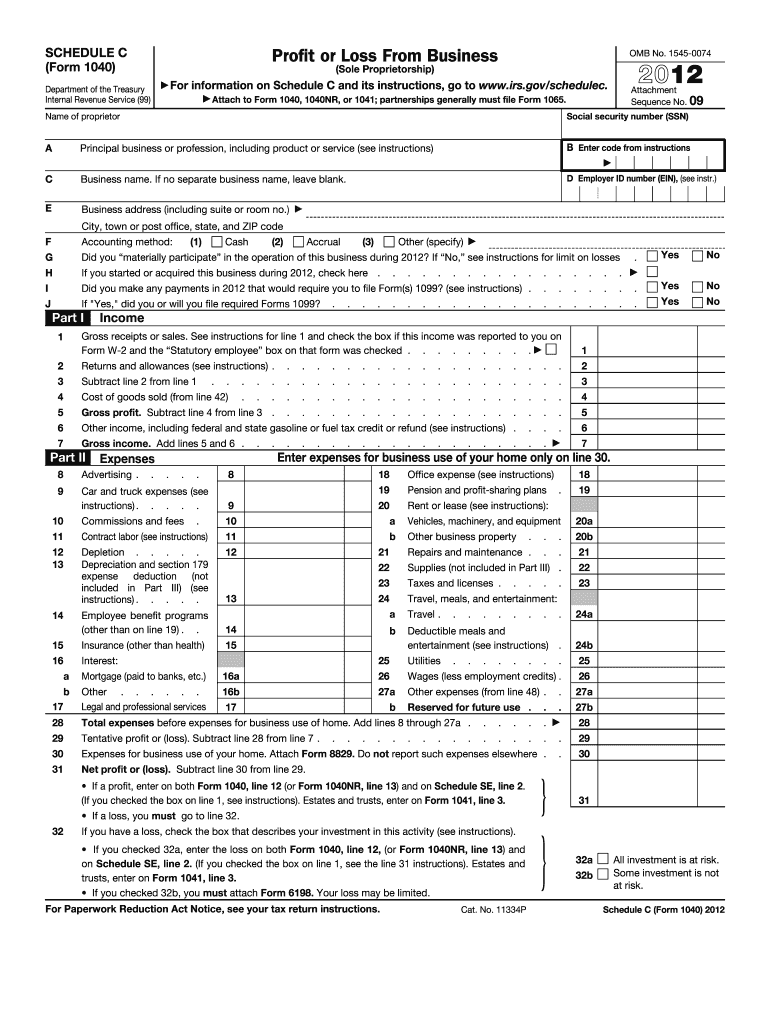

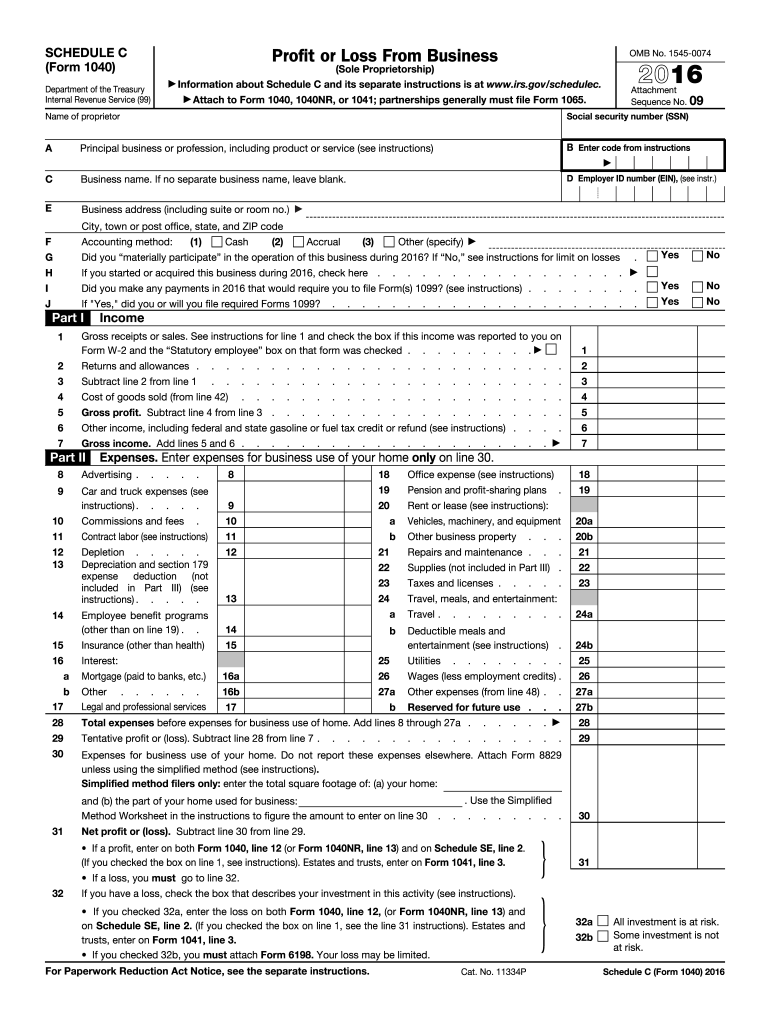

19 Schedule C Form Fill out, securely sign, print or email your 19 Instructions for Forms 1099A and 1099C IRSgov instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!A Schedule C Form is a supplemental form that is sent with a 1040 when someone is a sole proprietor Known as a Profit or Loss From Business form, it is used to provide information about both the profit and the loss sustained in business by the sole proprietor This form includes information about income for the business and its various expenses Schedule C 1099 MISC Form – In general, any organization which has paid at least $600 to some individual or any unincorporated business that has received at least two payment amounts from that person or business must issue a 1099 Form to every individual or business who has obtained at least one of those payment quantities This form is used by the IRS to make sure

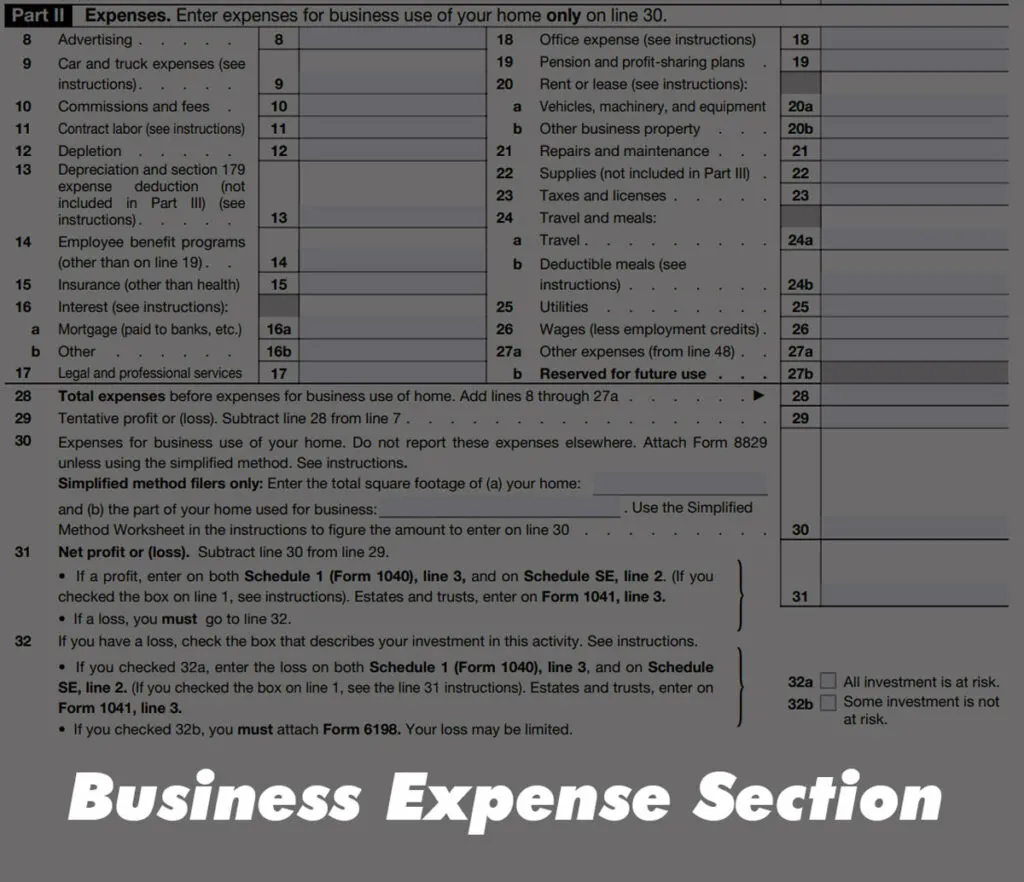

Form 1099C 21 Cancellation of Debt Copy B For Debtor Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this transaction and the IRS determines Form 1099C According to the IRS, nearly any debt you owe that is canceled, forgiven or discharged becomes taxable income to you You'll receive a Form 1099C, "Cancellation of Debt," from the lender that forgave the debt Common examples of when you might receive a Form 1099C include repossession, foreclosure, return of property to a lender Including 1099 Income on Your Tax Return How you report 1099MISC income on your income tax return depends on the type of business you own If you are a sole proprietor or singlemember LLC owner, you report 1099 income on Schedule C—Profit or Loss From BusinessWhen you complete Schedule C, you report all business income and expenses

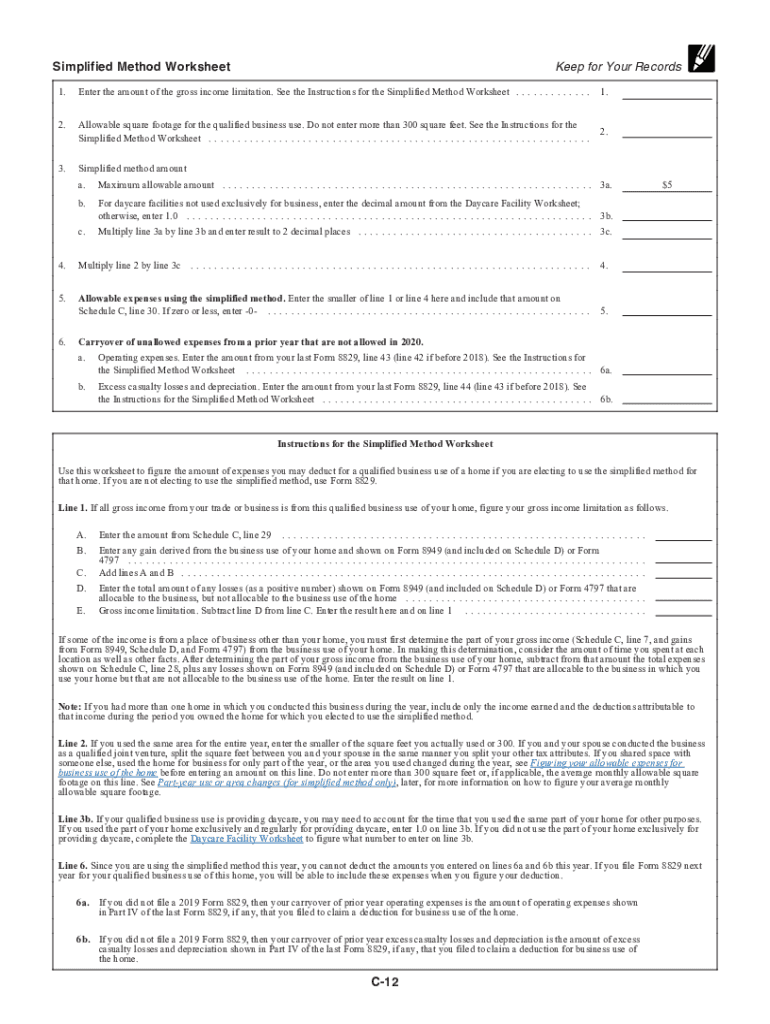

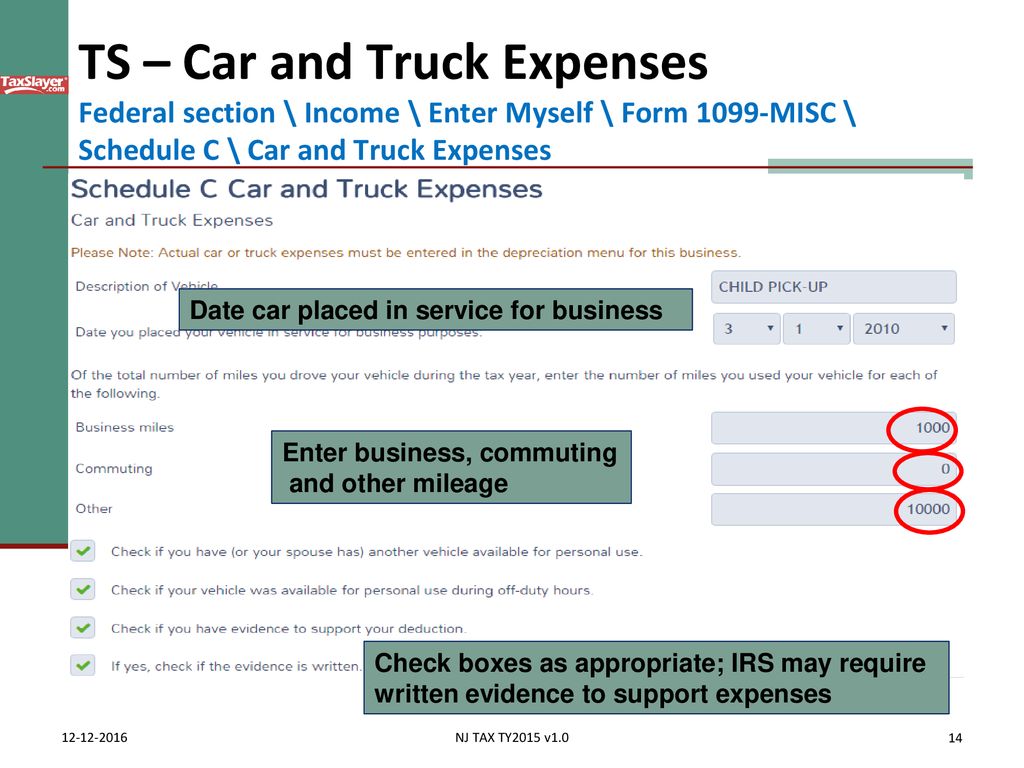

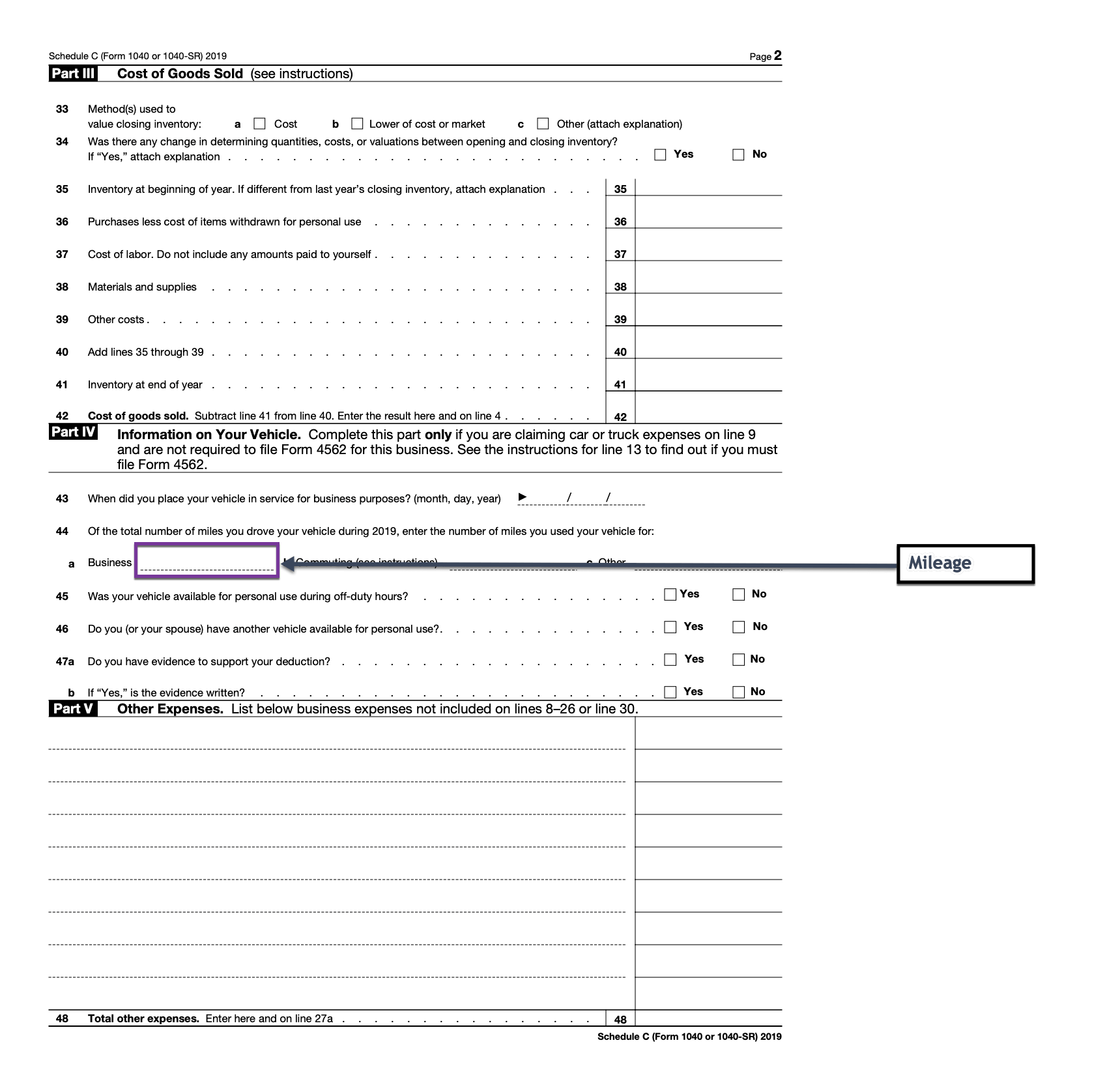

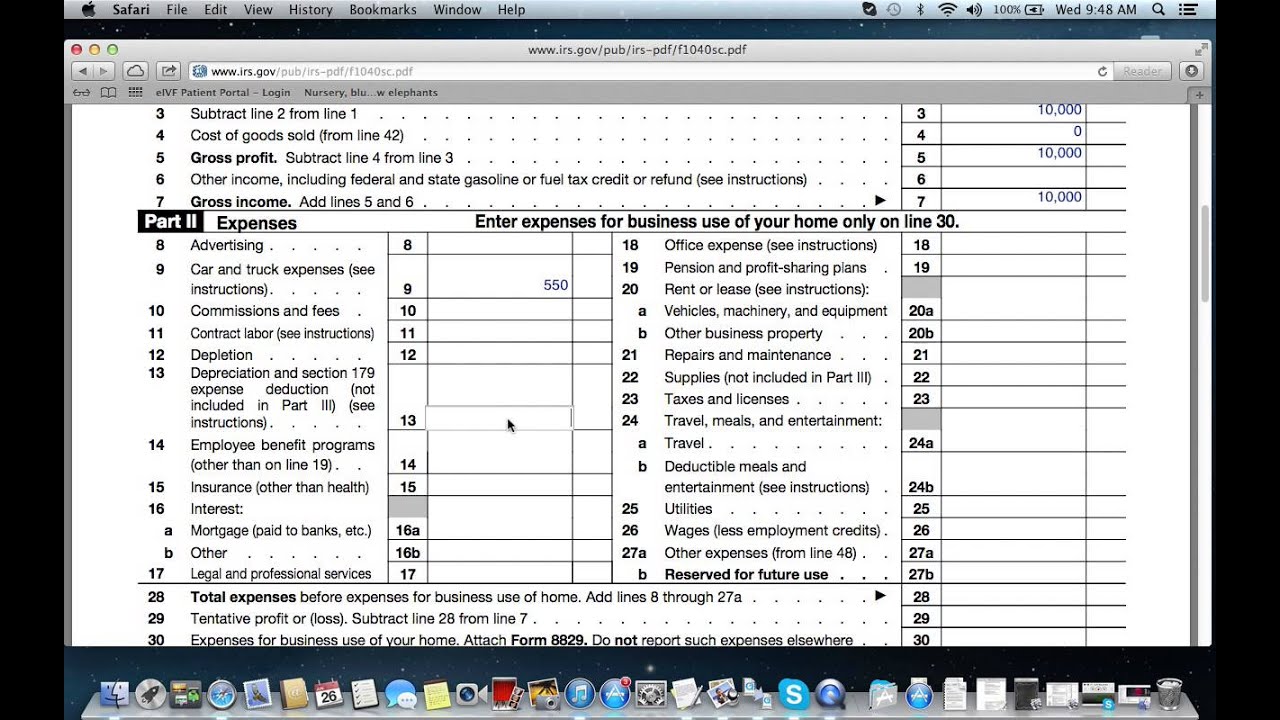

Here is Schedule C, Part 1 All of the contractor's income must be posted to Part 1, line 1 of Schedule C (Gross receipts and sales) This includes income reported on 1099 forms, and payments under $600 that did not require a 1099 form The contractor's business net income is posted to Schedule 1 of Form 1040, and the amount is added toUsing TaxAct When filing a 1040 for sole proprietorship this is how to file everything so you can get the pdf that you need to submit your application Doin The Schedule CEZ is a shorter version of the Schedule C form It's shorter because it skips some of the less common sections or additional forms of the Schedule C that take a bit longer to fill outfor example, the depreciation or home office deduction forms You can file the Schedule CEZ if you Had business expenses of $5,000 or less

How To File For Taxes As A 1099 Worker Form Pros

Basic Accounting Forms Irs Forms For Your Small Business

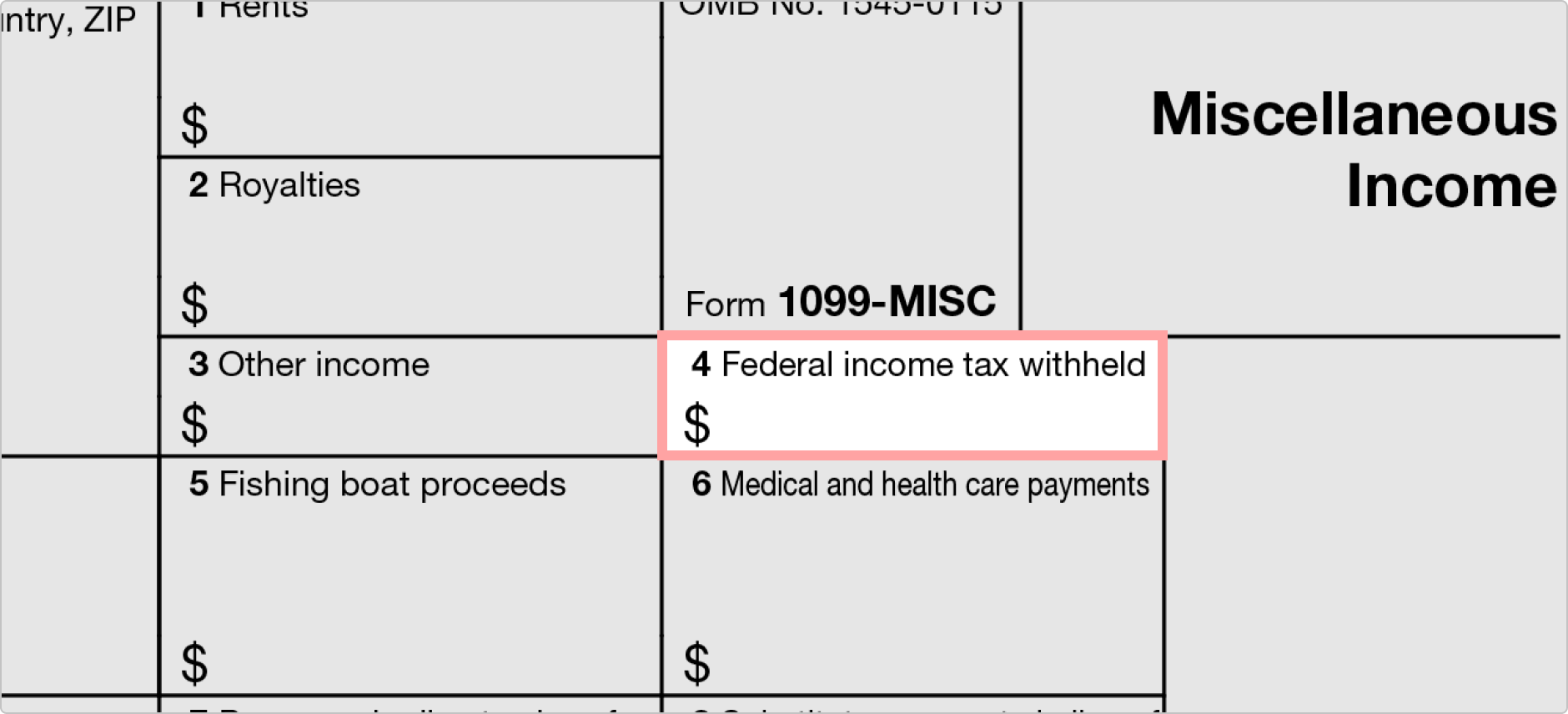

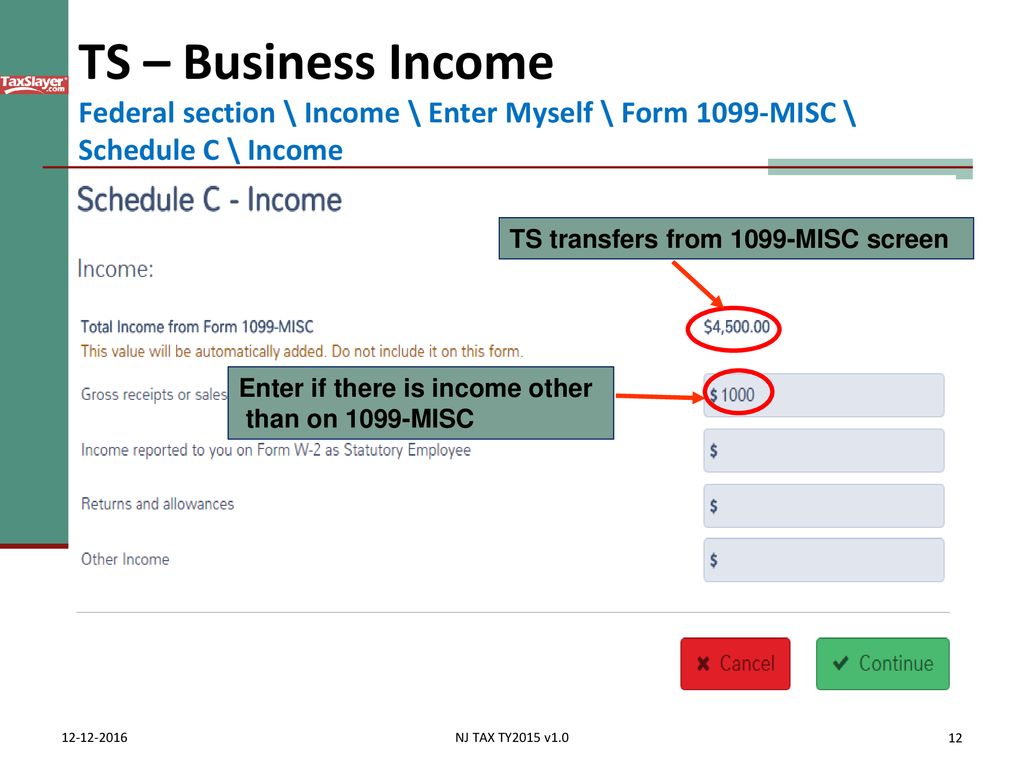

In this video, you will learn how to add a Schedule C, Profit or Loss From Business, to a 1040 return using MyTAXPrepOffice You will also learn how to addMark them for the Schedule C and be sure to enter a multiform code ProWeb – Form 1099Misc and Schedule C Form 1099Misc is used to report any miscellaneous income to a taxpayer that would not be included on a Form W2 This income can be for services, rents, royalties, prizes, etc Generally, any amounts in box 3 of the Form 1099Misc can be reported as Other Income on Form 1040, Line 21

How To Fill Out Schedule C Stripe Help Support

Www Irs Gov Pub Irs Prior I1040sc 18 Pdf

Partnerships generally must file Form 1065 OMB No 19Form 1099C (entitled Cancellation of Debt) is one of a series of "1099" forms used by the Internal Revenue Service (IRS) to report various payments and transactions, excluding employee wagesIf you receive a 1099K, the IRS requires this income to be reported as income on the Schedule C For more information about the 1099K, please click here To complete a Schedule C within the program, go to Federal Section;

Where To Send 1099 Misc Forms Irs 17 Beautiful Irs Gov Capital Gains Worksheet New Schedule C Tax Form 18 4 19 15 Models Form Ideas

1099 Misc Form Fillable Printable Download Free Instructions

1040 AM You dont need the 1099 to report Sch C income, just enter all business income on Line 1 of the Sch C (since most self employed people have income in addition to the 1099 anyhow), as long as all income gets reported, that's all thats needed 0416 PM I am sorry but surely you need themThe income received on Form 1099K should be included in the gross receipts of the taxpayer's business income For a sole proprietor, Form 1099K receipts are reported on Schedule C For a partnership or corporation the income is reported as part of the company's gross revenueFollow the instructions below to correctly enter the Form 1099NEC and linked it to the proper Schedule 1 Click Add Form (Ctrl A) 2 Select FRM 1099NEC Nonemployee Compensation 3 Complete the required fields (check Verify messages) 4 Select the Link to (1040, Sch C, or F) field, and choose Choices (F3 for shortcut) from the active

Form 6 A Schedule C 4 Pdf Fill Online Printable Fillable Blank Form Com

Taxes For Lyft Drivers What If I Didn T Receive A 1099 From Lyft Laptrinhx

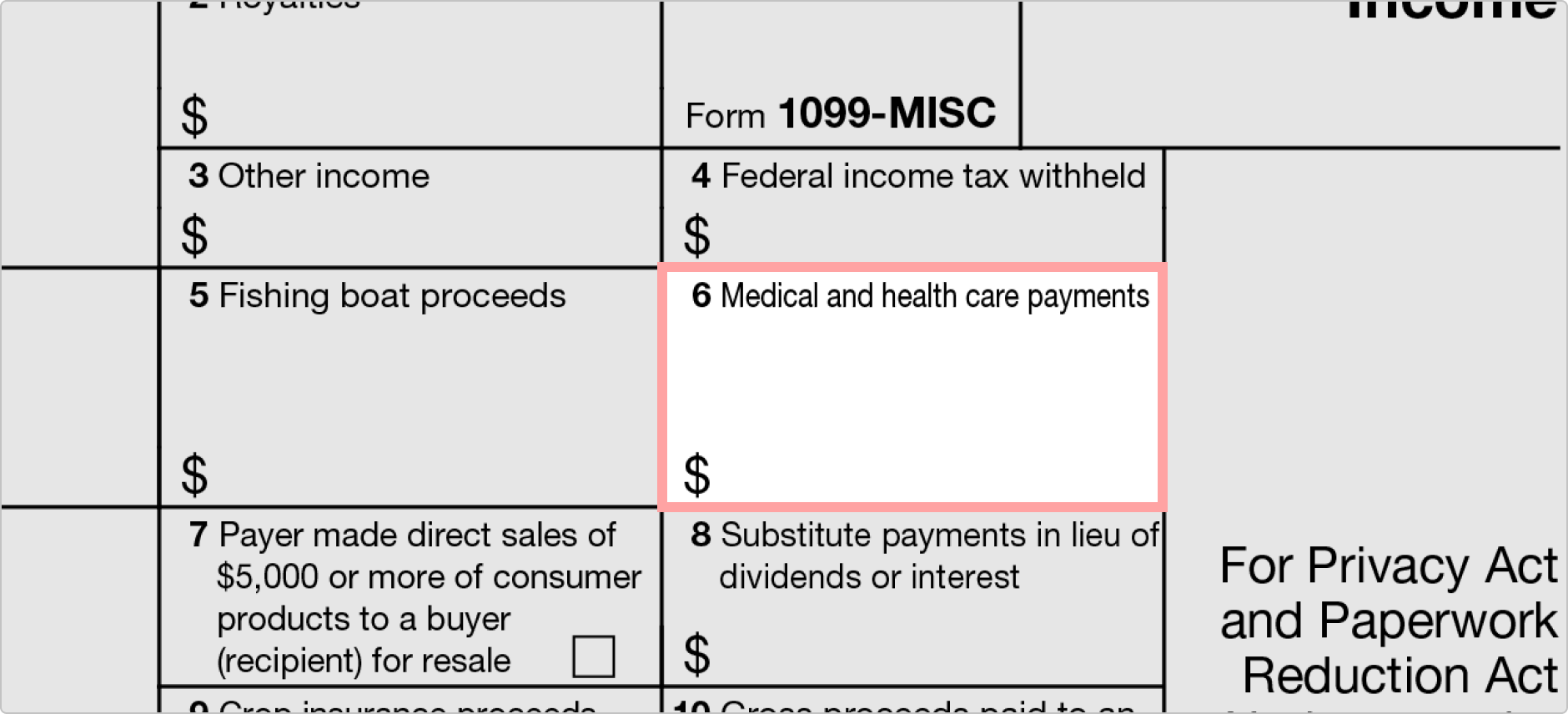

Form 1099MISC, Miscellaneous Income Taxpayers may receive other business income on Form 1099MISC, Boxes 2 and 3 Refer to Schedule C instructions for more information Form 1099K, Payment Card and Third Party Network Transactions Form 1099K is used by thirdparty networks (such as Visa, Mastercard, or others) to report transactions Answer Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship) Also file Schedule SE (Form 1040), SelfEmployment Tax if net earnings from selfemployment are $400 or more This form allows you to figure social security and Medicare tax due on your net selfemployment incomeA Schedule C form is the tax form used by a sole proprietor to calculate his business's net profit or loss This amount will then be used on the proprietor's personal income tax return to figure out his total tax liability for the year The Schedule C form is submitted as part of an income tax filing Here's What We'll Cover

Schedule C Business Codes Fill Online Printable Fillable Blank Pdffiller

1095 C Form 18 Best Of Amazon Flex 1099 Forms Schedule C Se And How To File Taxes Form Q Models Form Ideas

When completing the Schedule C, you are only required to include an appropriate business code and description in theIf you, as an independent contractor, have registered yourself as a company with a single member as in, an LLC/Sole Proprietor, then your income is reported on a schedule C form You need to remember to add your 1099 income to all your other revenueSchedule C Multiple 1099MISC for Same Business Here are the steps you need to take to prevent the software from producing multiple Schedule Cs for a single business from multiple 1099M entries Enter a Schedule C with the profession, business code, and name of the business Enter the 99M screens;

How To Report 1099 K Income On Tax Return 6 Steps With Pictures

Apps Irs Gov App Vita Content Globalmedia Teacher Schedule C Business Income Pg1 4012 Pdf

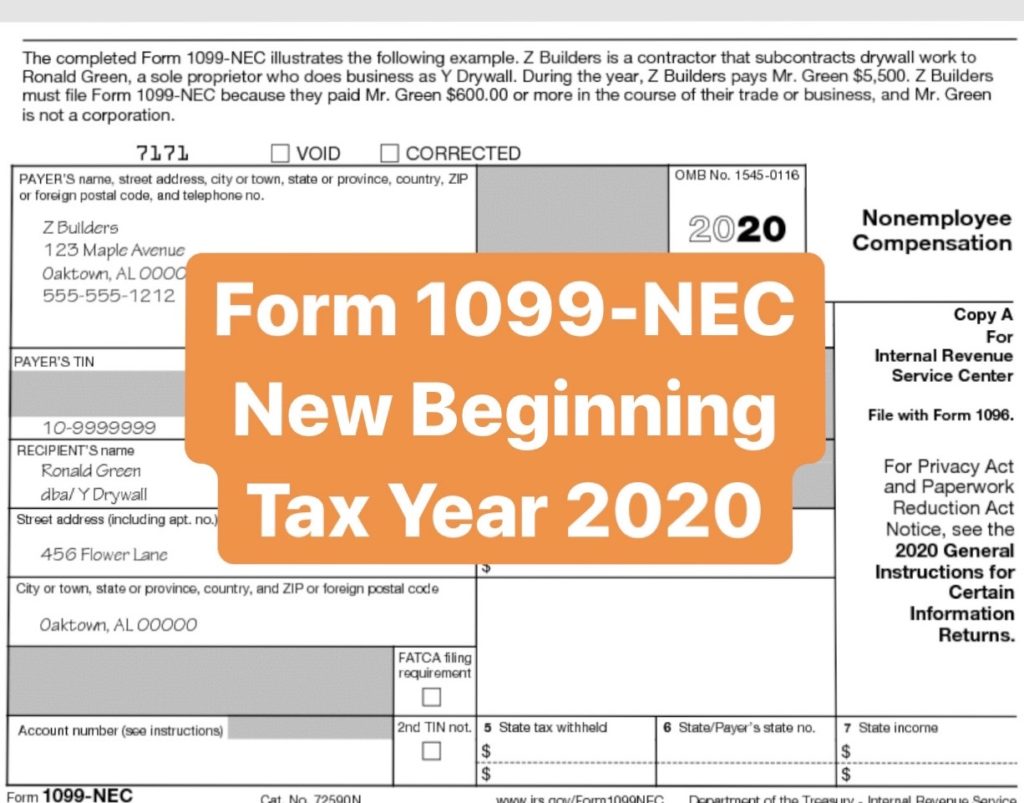

The 1099NEC is the form that the payer uses to report nonemployee compensation paid to an individual Schedule C is the form that the recipient uses to report that compensation, plus any other income received for doing the same work On Schedule1099CAP Changes in Corporate Control and Capital Structure Independent contractors use the Schedule C form to report business income If you're a 1099 contractor or sole proprietor, you must file a Schedule C with your taxes Your Schedule C form accompanies your 1040 and reports business income, expenses, and profits or

Tax Ohio Gov Portals 0 Forms Municipal Income Ohiocity Ohiocitytaxform Pdf

Changes To Ppp Including Self Employed And 1099 Ppp Now Based On Gross Income Homeunemployed Com

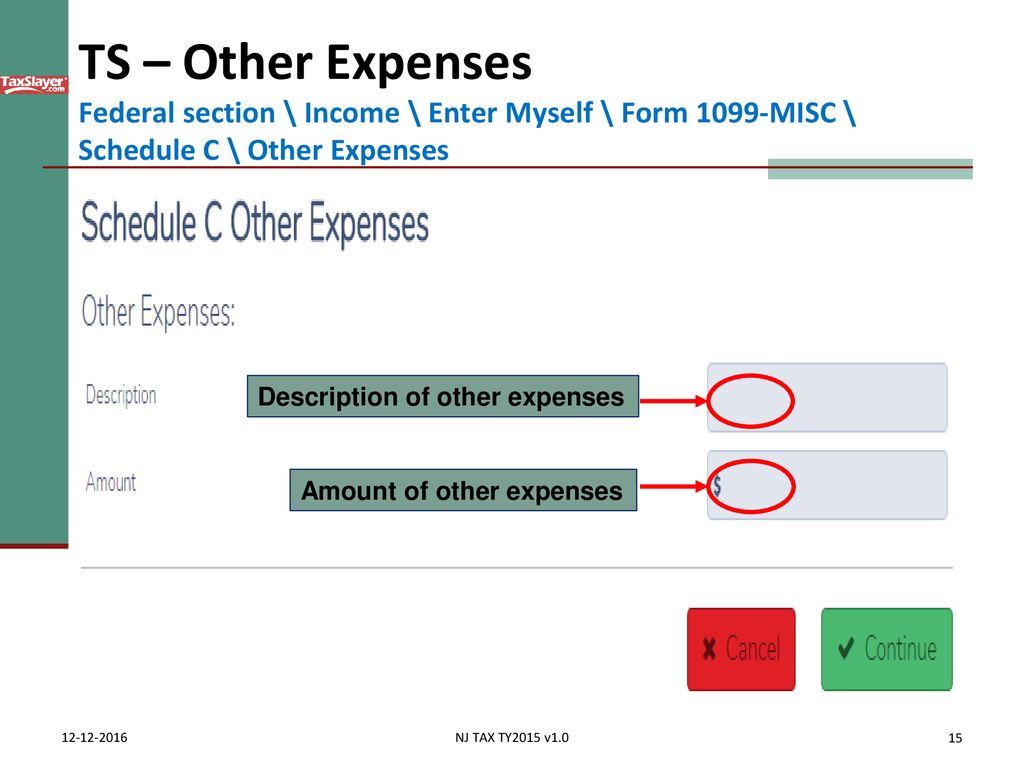

ProWeb Form 1099Misc and Schedule C Form 1099Misc is used to report any miscellaneous income to a taxpayer that would not be included on a Form W2 This income can be for services, rents, royalties, prizes, etc Generally, any amounts in box 3 of the Form 1099Misc can be reported as Other Income on Form 1040, Line 21SCHEDULE C (Form 1040 or 1040SR) Department of the Treasury Internal Revenue Service (99) Profit or Loss From Business (Sole Proprietorship) Go to wwwirsgov/ScheduleC for instructions and the latest information Sequence No Attach to Form 1040, 1040SR, 1040NR, or 1041;If you have multiple Schedule C forms and multiple 1099M/1099NEC forms, make sure you enter the correct MFC (Multiform Code) In the example below, the florist would be MFC 1, landscaping MFC 2, and woodworking MFC 3 Delete the additional Schedules C that were generated incorrectly by the 99M/99N screen (s)

Tips On Using The Irs Schedule C Lovetoknow

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

To associate the 1099MISC or a 1099NEC to a Schedule C, perform the following steps in the program After entering the information, click Continue to save and be taken to the next page You will then be asked where you want to add the income You can Create a new Schedule C or add the income to an existing Schedule C (same type of work) Reporting 1099C Income If you get a 1099C for a personal debt, you must enter the total on Line 21 of Form 1040 personal income tax If it's a business or farm debt, use a Schedule C or Schedule F, profit and loss from business or farming Include as income any interest you would have been eligible to deduct Master's Degree 2,630 satisfied customers If I already entered the form 1099NEC for both grubhub and hi, yes if I already entered the form 1099NEC for both grubhub and doordash, do I still need to also file a schedule c?

Form Irs 1040 Schedule C Fill Online Printable Fillable Blank Pdffiller

What Is Form 1099 Nec For Nonemployee Compensation

Any income reported on Form 1099NEC is not reportable directly on your tax return Since this type of income is considered selfemployment (nonemployee compensation) it must be linked to a Schedule C, even if there are no expenses being claimed To add a Schedule C so your 1099NEC can be linked Open or continue your return in TurboTaxPartnerships generally must file Form 1065 OMB No Attachment 09SCHEDULE C (Form 1040) Department of the Treasury Internal Revenue Service (99) Profit or Loss From Business (Sole Proprietorship) Go to wwwirsgov/ScheduleC for instructions and the latest information Sequence No Attach to Form 1040, 1040SR, 1040NR, or 1041;

Www Myrepublicbank Com Sites Www Myrepublicbank Com Files Files Form 1040 schedule c Pdf

Schedule C An Instruction Guide

Sim 14B Using Form 1099MISC to Complete Schedule CEZ, Schedule SE, and Form 1040 You are 16 years old and single You are a US citizen You live in the United States with your parents, who pay for all of the costs of maintaining your home You are a fulltime high school student After school and on weekends, you provide lawn careHow to enter income reported to you on Form 1099K Generally, if you're an independent contractor or selfemployed, your Form 1099K income will be reported directly on a Schedule C, Profit or Loss from a Business To access the Schedule C, go to Federal Section Income Select My Forms Profit or Loss from a Business Reported on Schedule C1099C Cancellation of Debt;

Irs Instructions 1040 Schedule C 21 Fill Out Tax Template Online Us Legal Forms

How To File Schedule C Form 1040 Bench Accounting

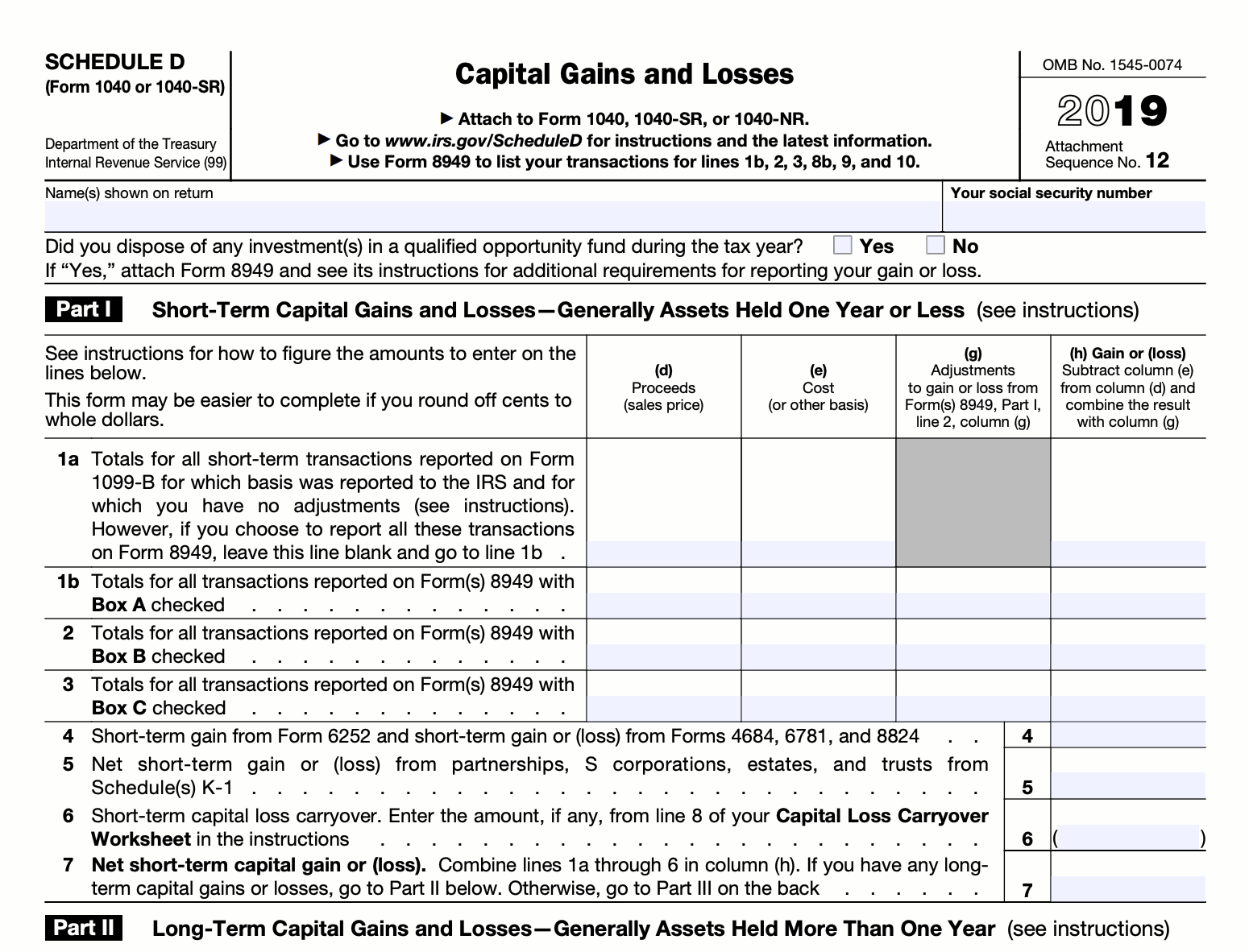

Most individuals' 1099K form reports payments to their trade or business As such, the income for soleproprietors is reported on their Schedule C as gross receipts subject to the selfemployment tax Partnerships and corporations would report those amounts in a similar manner on their returns IRS enforcement of the 1099K form reporting1099B Proceeds from Broker and Barter Exchange Transactions; 1099 forms used by payers to report payments made to a taxpayer (or recipient) The most popular 1099 form is the 1099MISC which is used to report payments of $600 or more that were paid by the payer to a recipient Schedule C, which is sent with Form 1040, is used to report selfemployment income and calculate taxable profit

How To Enter Form 1099 Nec On A Tax Return Schedule C Crosslink Tax Tech Solutions

Www Irs Gov Pub Irs Prior F1040sce 17 Pdf

Module 14B Simulation Using Form 1099MISC to Complete Schedule CEZ, Schedule SE, and Form 1040 In this simulation, you will take on the role of James King in order to learn how to claim selfemployment incomeSchedule C and 1099 are two completely different forms Schedule C is the tax form you file with your income taxes that reports your income and expenses for your business 1099 is what a business may issue an independent contractor when they pay them over $600 It simply reports to the IRS how much they paid the contractor

How To Prepare A Schedule C 10 Steps With Pictures Wikihow

2

Business Income Schedule C Ppt Download

How To Report Cryptocurrency On Taxes Tokentax

1040 Schedule C 21 Schedules Taxuni

Tax Documents That Every Freelancer And Contractor Needs Form Pros

Business Income Schedule C Ppt Download

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

:max_bytes(150000):strip_icc()/ScreenShot2021-06-03at10.46.06AM-94eb26d209884e0e9190a59995dbee63.png)

What Is Irs Form 1099 C

Schedule C Instructions With Faqs

How To Enter Form 1099 Nec On A Tax Return Schedule C Crosslink Tax Tech Solutions

Tax Season Is A Time To Keep Cool A Writer S Guide To Missing 1099 Misc Forms And Unpaid Royalties Dalecameronlowry Com

1099 Misc Form Fillable Printable Download Free Instructions

How To Report Cryptocurrency On Taxes Tokentax

Www Guidestone Org Media Guidestone Corporate Ministry Tools Mintaxguide 2112 Mintaxguidesec4 Pdf La En

Entering Form 1099 Misc With Nonemployee Comp Crosslink Tax Tech Solutions

1099 Misc Form Fillable Printable Download Free Instructions

Www Irs Gov Pub Irs Pdf F1040sf Pdf

1

Taxslayer 21 Tax Year Review Pcmag

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

1040 Form 19 Pdf Schedule C

1099 Misc Form Fillable Printable Download Free Instructions

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

1040 Form 19 Pdf Schedule C

Www Guidestone Org Media Guidestone Corporate Ministry Tools Mintaxguide 2112 Mintaxguidesec4 Pdf La En

1

Tax Forms Irs Tax Forms Bankrate Com

Irs Form 1040 1040 Sr Schedule C Download Fillable Pdf Or Fill Online Profit Or Loss From Business Sole Proprietorship 19 Templateroller

What To Do With The Irs 1099 C Form For Cancellation Of Debt Alleviate Financial Solutions

How To File Taxes On Part Time Income Earned On Hubpages And Other Internet Marketing Sites Toughnickel

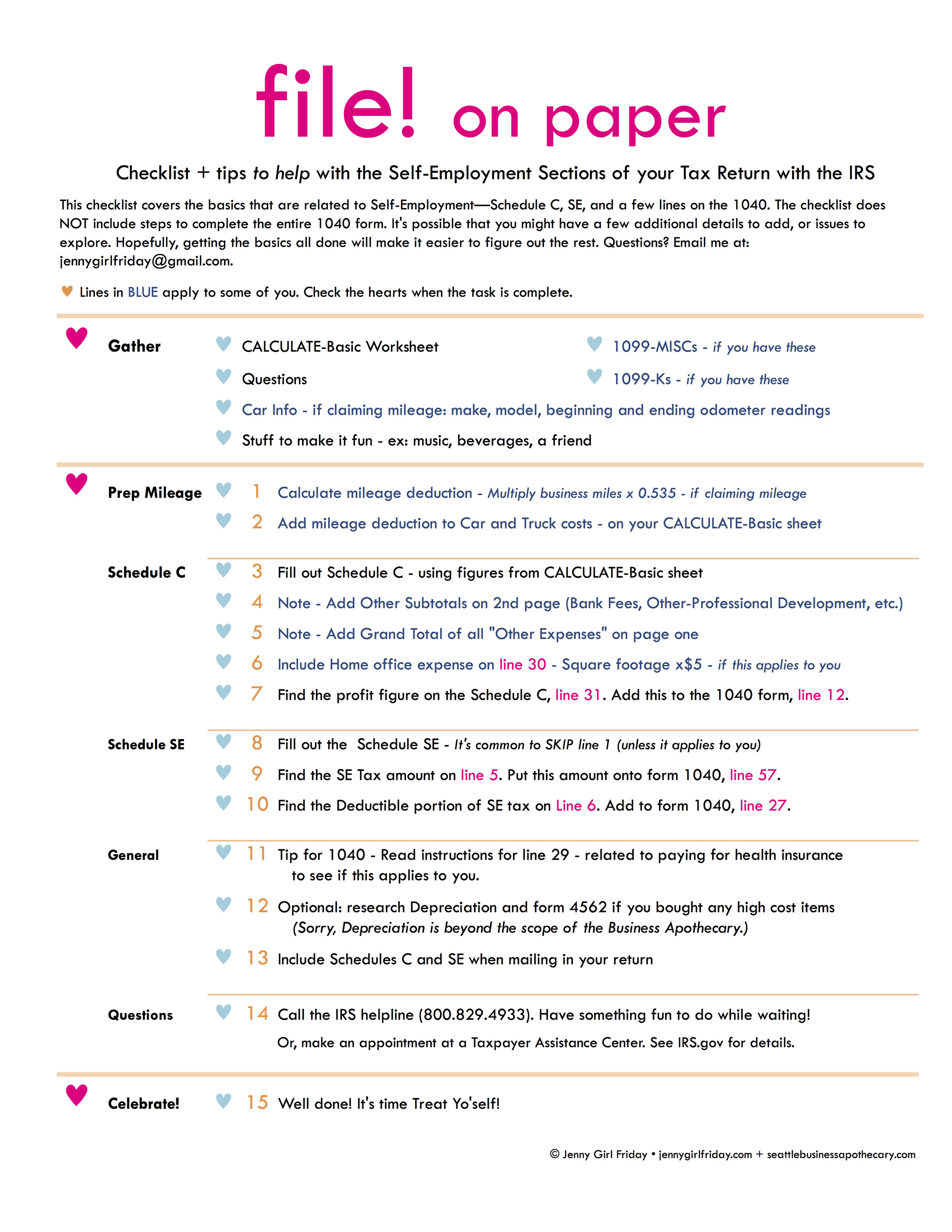

Jenny Girl Friday Irs Tax Prep Seattle Business Apothecary Resource Center For Self Employed Women

Www Irs Gov Pub Irs Pdf F1040sc Pdf

1

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

1

How To File A Tax Return With A 1099 Independent Contractor Tax Preparation Youtube

Business Income Schedule C Ppt Download

Ppp Application Guide For Gig Workers Self Employed Sba Ppp Loan

What Does It Mean When You Get A 1099

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

Form 1099 K Payment Card And Third Party Network Transactions Definition

Irs Schedule C Instructions Schedule C Form Free Download

What Is An Irs Schedule C Form And What You Need To Know About It

Intuit Proseries Tax Software Entering 1099 Misc And Schedule C On Vimeo

Business Income Schedule C Ppt Download

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Reporting Income For Grubhub Doordash Postmates Uber Eats Contractors

Doordash Taxes Schedule C Faqs For New Experienced Dashers

What Is A 1099 Form H R Block

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

How To Deal With A New 1099 C Issued On Old Debt Using Little Known Irs Form 4598

Ppp Second Draw Application Tutorial Self Employed Schedule C 1099 No Employees Homeunemployed Com

Prepare Schedule C Form 940 Form 941 1099 W2 By Pro Design1 Fiverr

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To File Your Taxes For Uber Lyft And Other Popular Gig Apps

Www Irs Gov Pub Irs Prior I1040sc 17 Pdf

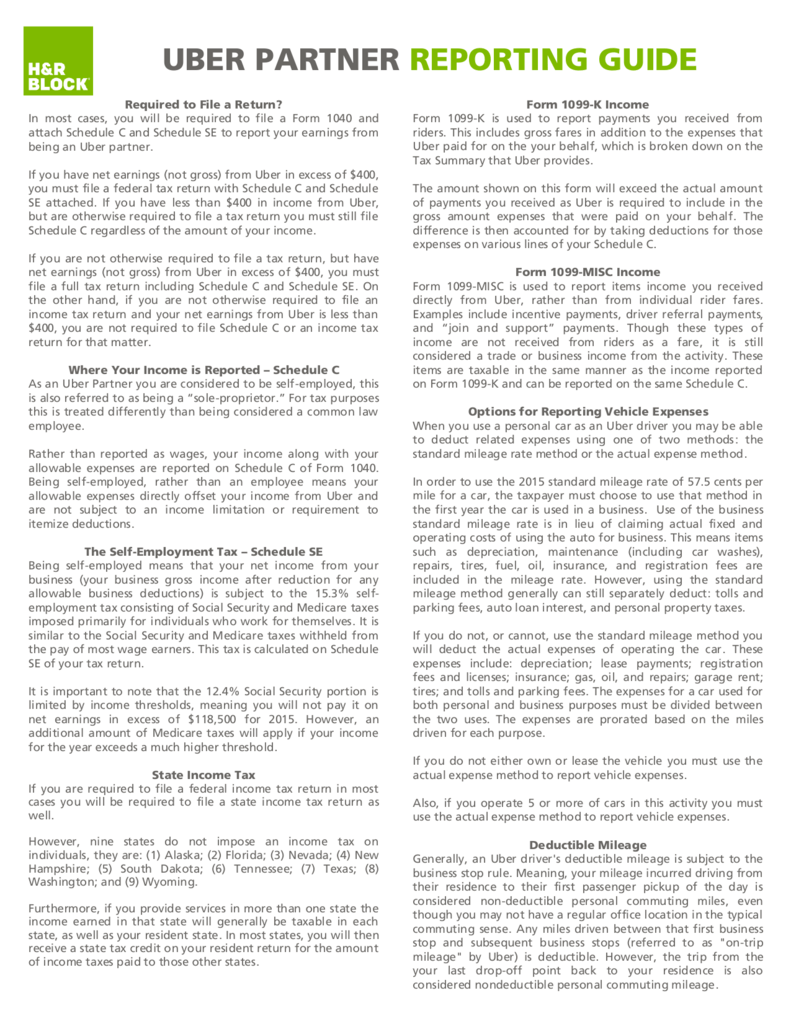

Uber Partner Reporting Guide

Self Employment 1099s And The Paycheck Protection Program Bench Accounting

How To Fill Out Schedule C For Business Taxes Youtube

Business Income Schedule C Ppt Download

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png)

Form 1099 Oid Original Issue Discount Definition

1040 Schedule C Form Fill Out Irs Schedule C Tax Form

Schedule C Filler Fill Online Printable Fillable Blank Pdffiller

/GettyImages-550437859-5734bfef5f9b58723d94e18c.jpg)

How To File Form 1040x To Correct Tax Return Errors

What You Need To Know About Instacart 1099 Taxes

Fill W2 941 1099 940 1040 Schedule C Tax Form By Tax Services Fiverr

Form 1040 Schedule C Profit Or Loss From Business Sole Proprietorship

Uber Tax Filing Information Alvia

Blank Irs Federal Tax Form Schedule C For Reporting Profit Or Loss From Business Stock Photo Alamy

Irs 1040 Schedule C 16 Fill And Sign Printable Template Online Us Legal Forms

1095 C Form 18 Lovely Amazon Flex 1099 Forms Schedule C Se And How To File Taxes Form Q Models Form Ideas

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

2

Diy Schedule C For Independent Salons And Stylists For Ppp Loan Best Tax Advice For Hairstylist Youtube

Schedule C Form 17 Fresh Form 1040 Pdf Models Form Ideas

1099 Misc Box 7 Schedule C

St Ores Wealth Management Schedule C For Sole Proprietor Independent Contractor Single Member Llc Ppp Loan Forgiveness Eidl Facebook

Fill W2 941 1099 940 1040 Schedule C Tax Form And Job Letter By Pro Tax Service Fiverr

0 件のコメント:

コメントを投稿